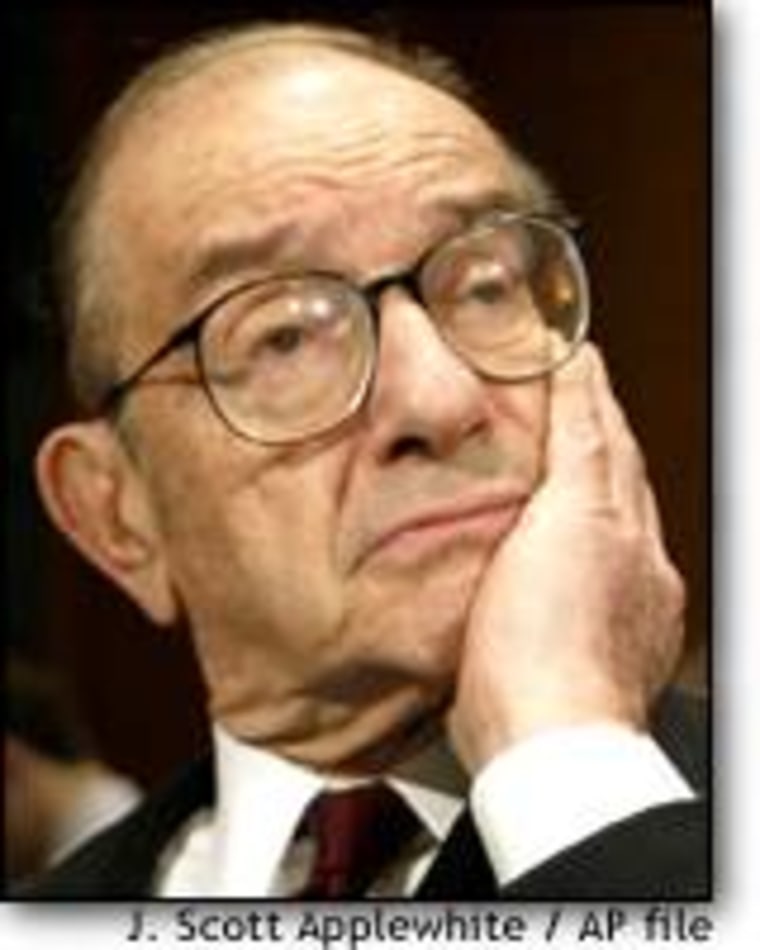

The bubble has burst, and the once-unthinkable is now being discussed openly: the possible forced departure of Federal Reserve Chairman Alan Greenspan. But despite an open rift between Greenspan and the Bush administration over tax-cut plans, don’t count the influential Fed chief out just yet.

Conservative columnist Robert Novak stirred up a tempest this week with an article contending that unidentified advisers to President Bush are “so angry” at Greenspan they are considering replacing him when his term as chairman expires in June 2004. Novak’s syndicated column set into motion the odd scene of liberal Democratic Sen. Charles Schumer rushing to defend the Republican Greenspan against a supposed “whisper campaign.”

Greenspan’s offense? His comment in congressional testimony Feb. 11 that he is “not as yet convinced” fiscal stimulus is needed for the sluggish economy. The remark was a damaging blow for President Bush’s $695 billion tax cut proposal, although Greenspan offered grudging support to the elimination of dividend taxes that is at the heart of the plan.

After Novak’s column was published, the White House dispatched Glenn Hubbard to declare the administration has “zero concerns” with Greenspan. Oddly enough Hubbard — frequently mentioned as a possible successor to Greenspan — was himself gone by the end of the week, having resigned as chairman of the White House Council of Economic Advisers, the last original member of Bush’s core economic team.

Hubbard’s departure long had been expected, although the announcement late Wednesday was abrupt. Greenspan, on the other hand, appears a sure bet to weather the current uproar and remain in office through the end of his term as chairman — and possibly longer.

NO HINTS FROM FED CHIEF

Even though Greenspan turns 77 next week, he has given no indication he has any plans for retirement, although he surely would signal Wall Street well in advance. While the end of his fourth four-year term as chairman next year would be a logical time to step down, it is conceivable he would prefer to complete his full 14-year term on the Fed’s board of governors, which expires in early 2006.

Much depends on when and whether the sputtering economy picks up momentum and shows convincing signs of steady, robust growth.

“I really doubt the chairman would want to leave without the economy on a surer footing,” said former Fed Gov. Laurence Meyer, now a private consultant. “I think he wants to see the economy through the post-bubble part of the cycle before he voluntarily leaves.”

Meyer and others also said it would be nearly impossible — not to mention highly disruptive to financial markets — for Bush to try to win congressional approval of a new Fed chairman in the midst of a presidential election campaign.

While there may be some tension between the White House and the Fed chief, the famously political Greenspan has plenty of time to smooth things over with President Bush. Besides, President Bush’s recent appointments of fiscal conservatives to all three top economic posts in his administration prove there is no supply side litmus test being given at the gates of the White House.

“I don’t think Novak is wired in at all,” said former Fed Gov. Lyle Gramley of Schwab Washington Research Group. “In any event Greenspan has such enormous prestige in financial markets both here and abroad it would be most unwise for Bush to dump him. He has enough on his plate as it is.”

GREENSPAN ‘AGING VERY WELL’

Many economists believe the economy is showing signs of strength, particularly in manufacturing, that could mean relatively strong growth by the end of this year, allowing Greenspan to make a graceful exit in 2004 or 2005.

If the economy weakens further, Greenspan likely would want to stay on to offer his guidance, and few who have met with the chairman recently doubt that he is up to the task. “If you look at the man he is aging very well,” said Gramley. “If you read his stuff it’s just amazing the analytical acuity he has maintained, and the ability to hold data within his memory.”

Greenspan has left open the possibility that he would change his view on the need for fiscal stimulus if the slowdown persists or worsens. In any case he likely will continue to insist on long-term budgetary discipline, as he did this week when he urged Congress to act soon to fix long-term structural problems in the nation’s Social Security and Medicare problems.

“He’s being true to himself — he’s always been a fiscal conservative,” said Diane Swonk, chief economist at Bank One. “It’s not like a new message.”

While Greenspan’s reputation has taken a beating in recent years, his legacy is well assured, having presided over the longest economic expansion of the postwar era and shepherded financial markets through the 1987 crash and the terror of Sept. 11, 2001. But perhaps it is not a bad thing that his aura of invincibility has been shattered, making it a bit easier to contemplate the Fed in a post-Greenspan era.

BUT WHO MIGHT HEAD THE FED?

Any guessing game about who might succeed Greenspan is probably premature and doomed to failure, but certainly Hubbard, 44, is a name to be reckoned with. By most accounts his decision to return to a teaching post at Columbia was a personal one based on family considerations. He was considered perhaps the most effective spokesman for Bush’s economic policies, although he has taken some heat for the design of the dividend tax-cut plan, seen as overly complex.

Other names that have been prominently mentioned include:

Martin Feldstein. The enormously influential Harvard professor, 63, has guided a generation of conservative economists. Served as head of President Reagan’s Council of Economic Advisers in the early 1980s.

John Taylor. Former Stanford University economist, 56, has gained prominence in his role as Treasury undersecretary for international affairs. Best known for the “Taylor rule” designed to predict optimum short-term interest rate levels. Considered a cogent spokesman for Bush’s economic policies, but not especially close to Wall Street.

David Malpass. Chief international economist for Bear Stearns, he is well plugged in to both Wall Street and Washington. Served in Treasury and State departments under President Reagan and the first President Bush and has worked as a congressional staffer.