Fake Romeos are getting rich off women ages 50 and older, who are by far the biggest victims of online romance scams, federal authorities reported Tuesday in detailing an 8 percent rise in U.S. Internet crime last year.

Romance scams most often are operations in which the victim is sucked in by a fake profile on an online dating site and hands over cash or other gifts.

The most notorious recent incident involved Notre Dame linebacker Manti Te'o, whose "girlfriend" and her heart-tugging death to leukemia turned out to be an online hoax. But it's much more common for older women to be victimized, according to statistics released Tuesday by the Internet Crime Complaint Center, or IC3, a joint project of the FBI, the National White Collar Crime Center and the Bureau of Justice Assistance.

More than 10 percent of all reported online financial losses last year — about $56 million out of $525 million overall — involved romance scams, the center reported in its 2012 crime roundup.

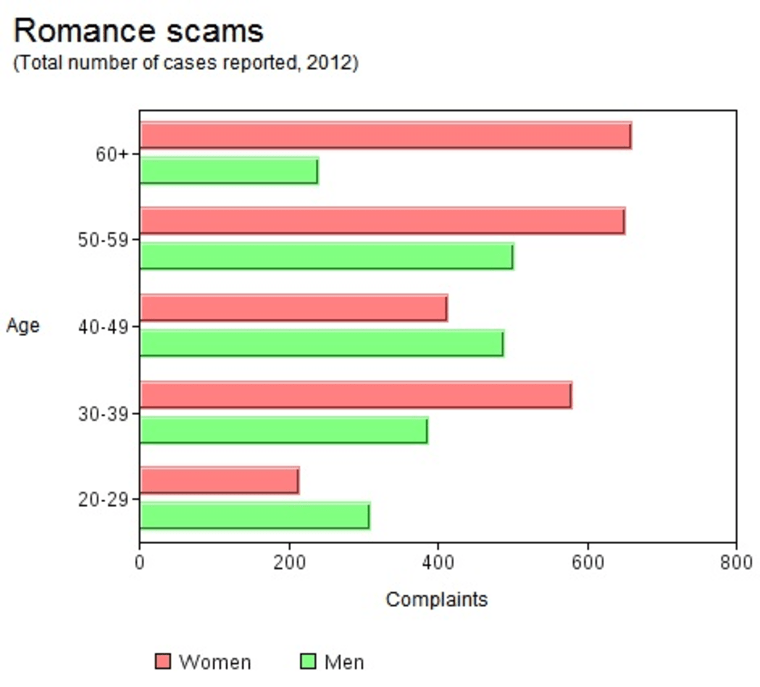

The IC3 report tabulated that 29 percent of those specifically targeted in such scams last year were women 50 and older:

But they got taken for more than $34 million — 61 percent of all losses to such cons:

By comparison, everybody else — younger women and all male victims — reported only $22 million in losses, according to the report.

"Middle-aged or older women are what I see being susceptible to another man who manipulates them for either money or sex," Justin D'Arienzo, a psychologist and dating coach in Jacksonville, Fla., told NBC station WTLV after a 60-year-old Jacksonville woman was victimized earlier this year.

Overall, losses to Internet crime rose by 8.3 percent in 2012, breaking the half-billion-dollar mark for the first time — further establishing that "criminals are increasingly migrating their fraudulent activities from the physical world to the Internet," said Richard McFeely, executive assistant director of the FBI's Criminal, Cyber, Response and Services Branch.

In response, IC3 said in a statement that it has expanded its education programs to alert the Americans to online scams.

"As technology continues to advance, so will our efforts to stay one step ahead of cyber criminals," said Don Brackman, director of the National White Collar Crime Center.

The breadth of romance trolling is further illustrated by a startling statistic: Only one other type of online scam — auto fraud — made more money last year, accounting for $65 million in reported losses.

Men — who made up a slight 52 percent-to-49 percent majority of all online victims — were the target of choice for bad guys using cars as lures, accounting for 60 percent of such scams last year.

Historically, online auto fraud has involved scammers who try to sell cars they don't own. But the IC3 noted a new flimflam in 2012: criminals who "pose as dealers instead of individuals selling a single car."

"This allows them to advertise multiple vehicles for sale at one time on certain platforms, potentially exposing more victims to the scam," it said.

The figures in the report are likely to be significantly underreported; security experts have warned for years that computer crimes often aren't reported, either because the victim doesn't know whom to call or is too embarrassed to admit having been taken in. And the report almost exclusively tabulates complaints registered in the U.S., meaning it's not a good picture of the entire world of Internet fraud.

But it does provide an interesting snapshot of what the bad guys are doing and how.

Other schemes that accounted for statistically significant losses were:

- Real estate fraud — rental scams, fake time-share marketing, bogus loan modifications and the like — cost a reported $15.4 million.

- General intimidation or extortion — $10.6 million.

- Impersonation of an FBI agent to trick computers into revealing sensitive financial or personal data — $2.3 million.

- The tried and true "hit man" protection scheme, in which the victim is told that he or she has been targeted by a hit man, who'll call off the hit in return for a large sum of money — $1.2 million.

How to stay safe online

Security specialists offer these tips if you suspect you might be dealing with a scam artist:

- Be suspicious if your correspondent accepts only wire transfers or cash.

- If you're buying merchandise, make sure it's from a reputable source. Be wary, for example, of businesses that operate from post office boxes or mail drops.

- Never click on an unsolicited e-mail; instead, go directly to the organization's official website.

- Never give out your credit card number unless you're certain the site is secure and reputable.

The FBI offers an extensive list of warning signs and tips here.

You can file an online fraud complaint here.

Follow M. Alex Johnson on Twitter and Facebook.

Related:

Read the entire IC3 2012 report (.pdf)

Red Tape Chronicles: Net users fall for fake online lovers all the time