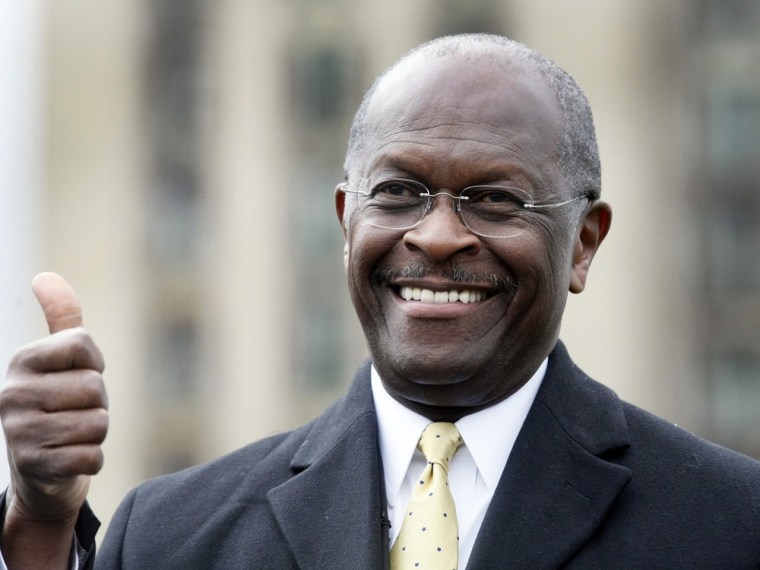

Herman Cain does not believe that his 9-9-9 Plan is the best long-term choice for the U.S. Tax Code. Surprised? It’s right there on his website. The pizza magnate and Republican Presidential candidate sees his triple-9 proposal as an interim fix and advocates another tax plan entirely for the long run. Vows Cain at hermancain.com: “Amidst a backdrop of the economic renewal created by the 9-9-9 Plan, I will begin the process of educating the American people on the benefits of continuing the next step to the Fair Tax.”

If the “Fair Tax” is what Cain really wants, then his supporters and critics should probably be focusing more on it and less on 9-9-9. Formally known as the FairTax (one word), it isn’t perfect, but it’s conceptually sounder than 9-9-9. And it belongs to a class of tax reforms that might do more to achieve what Cain says he wants, which is simplicity, fairness and the potential for boosting economic growth. (Texas Governor Rick Perry tried to one-up Cain on Oct. 19 by promising he would soon announce a flat tax “so simple that even Timothy Geithner can file his taxes on time.”)

The FairTax that’s Cain’s ultimate goal is the creation of Leo E. Linbeck Jr., a wealthy, 77-year-old Houston builder who devised it with some friends in 1996 after commissioning research by economists and consulting focus groups. It’s a straightforward tax on consumption that spares savings, a concept that appeals to economists of various political stripes. It would be imposed as a 30 percent federal retail sales tax that replaces the personal and corporate income taxes as well as the gift, estate, capital gains and payroll taxes. Republicans in Congress have introduced FairTax bills repeatedly without it breaking through; the latest has 66 co-sponsors in the House (including one Democrat) and eight co-sponsors in the Senate.

Bloomberg Businessweek: What 9-9-9 means for rich and poor

Cain not only supports the FairTax; he served as a volunteer national spokesman for several years in the 2000s. Linbeck says he hasn’t discussed the 9-9-9 Plan with Cain, whom he calls a good friend, “except to the extent that he sees 9-9-9 as a segue into the FairTax. We didn’t talk about the details. I didn’t see any reason to, frankly.”

The two plans would achieve different results. The 9-9-9 proposal would raise the tax burden on the lowest-earning workers while cutting the burden on the highest earners. Bruce Bartlett, a former Reagan Administration official, calls it a “distributional monstrosity.” (There is an exception at the top: The idle rich, who live off their wealth, would suffer from the consumption tax without benefiting from the lower tax on wages.) The FairTax would be lighter on the poor, though how much lighter is a matter of dispute.

Cain portrays the 9-9-9 Plan as a 9 percent individual income tax, a 9 percent business tax, and a 9 percent sales tax. But how taxes are labeled doesn’t necessarily match who effectively pays them. Daniel N. Shaviro, a professor of tax law at New York University School of Law, says businesses would pay the tax levied on them by reducing workers’ pay, while the sales tax would cut into the spending power of wages. The upshot, says Shaviro, is that 9-9-9 boils down to a 27 percent tax on workers’ wages. Few economists have endorsed 9-9-9 aside from former Reagan aide and supply-sider Arthur Laffer.

Bloomberg Businessweek: Herman Cain: Mine. Mine. Mine

The FairTax has garnered support in conservative economic circles from the likes of Nobel laureate Vernon L. Smith and former Federal Reserve Governor Wayne Angell. But even there, economists — a schismatic bunch — see room for improvement. Laurence J. Kotlikoff, a Boston University economist who is a columnist for Bloomberg View and previously endorsed the FairTax, now proposes what he calls the Purple Tax (a blend of red and blue), a consumption levy that he says cleans up some problems with the FairTax. It taxes the benefits that homeowners get from living in their own homes. That catches people who would shelter income by buying big houses. It also attempts to tax Americans’ consumption abroad. And it would tax inheritances and feature a payroll tax that, in a nod to liberals, exempts the first $40,000 of income and has no ceiling.

Tax evasion is a potential drawback of both the FairTax and Kotlikoff’s Purple Tax. The rates would be so high that people would have a strong incentive to dodge the levies. One option is to impose them as value-added taxes, as more than 100 other countries do. The VAT is collected incrementally at each stage of production, creating a paper trail and shrinking the sales tax imposed at the cash register. But both Linbeck and Kotlikoff argue that’s not necessary.

The usual rap on consumption taxes is that they are bound to fall more heavily on poor people than the current tax code does. But that flaw can be corrected by paying people a lump sum to lighten the burden. Linbeck’s group, Americans for Fair Taxation, calls it a “prebate,” while Kotlikoff calls it a “demogrant.” Cain’s 9-9-9 Plan doesn’t appear to offer a lump sum, which helps account for its regressivity.

Bloomberg Businessweek: Rick Perry needs a miracle

Why doesn’t Cain go straight to the FairTax, if he thinks it’s a better solution? Richard Lowrie, Cain’s adviser on economic issues, responds in an e-mail saying, “The country is tired of economists passing up something great, while they hold out for their own view of perfect, and in doing so, sentence the country to more of the same.” The tax plan that sounds like a pizza price is, evidently, not going away.

The bottom line: Cain’s 9-9-9 Plan amounts to a 27 percent tax on wages. It isn’t taken as seriously by economists as his less-publicized FairTax.