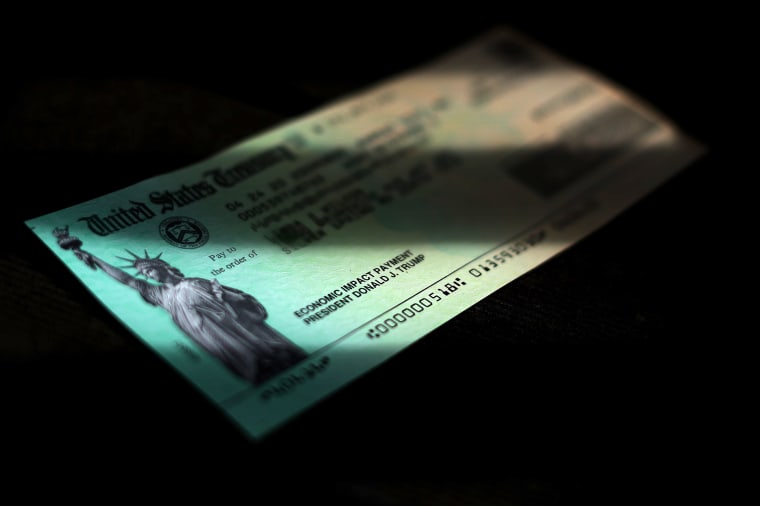

The Internal Revenue Service is making a last-ditch effort to reach 9 million Americans who are eligible for — but have not yet claimed — their CARES Act stimulus money. The tax agency said it will send out letters later this month alerting people who didn’t file federal taxes for 2018 or 2019 but meet the income criteria.

“The good news is that millions of Americans who never received the COVID-19-related stimulus funds have another chance to get their fair share of this distribution," Jack Gillis, executive director of the Consumer Federation of America, said. "The bad news is that the IRS needs to find you."

The stimulus checks were sent out first to tax filers, then to people such as seniors, veterans and the disabled. Others, including people who don’t file taxes or get federal benefits, are eligible for the funds — but since they’re not on Washington’s radar, the IRS doesn’t have a way to send them that money.

By definition, these are the poorest Americans — people whose incomes fall below the threshold required to file taxes — which is $12,200 for single filers under the age of 65. People can get payments of up to $1,200, and married couples can get up to $2,400. Parents of minor children (as of the end of last year) might qualify for an additional $500 for each kid.

People have to register by filling out this form on the IRS website. There are resources to help these people navigate the process — primarily social welfare nonprofits, although tax prep giant H&R Block also has an online tool to help non-filers register to get their stimulus money.

The IRS said it will send out a letter starting on Sept. 24, alerting non-filers that they have stimulus payments they can claim.

"This money means more to them than to anybody else, but they’re the hardest to reach."

That’s not a lot of time, said Ed Mierzwinski, senior director of federal consumer programs at the nonprofit Public Interest Research Group. The deadline for people to fill out the form for eligible non-filers is Oct. 15. The deadline for non-filers with kids to claim the additional $500 child payment is even earlier: Sept. 30.

“It’s par for the course for this administration,” Mierzwinski said. “I hope that the Democrats insist that that deadline be extended,” he added, given that some of the volunteer income tax assistance programs and low-income taxpayer clinics catering to this population have had to scale back their services or switch to a virtual-only format as a result of the pandemic.

“This money means more to them than to anybody else, but they’re the hardest to reach,” said Chuck Marr, director of federal tax policy for the Center on Budget and Policy Priorities, a left-leaning think tank that spearheaded an online outreach effort over the summer telling people if they were eligible and how to file for their stimulus payments.

The people that have fallen through the cracks, Marr said, are many of those who are enrolled in state-administered programs like food stamps and Medicaid, but don’t get federal benefits. “They struggle during good times, but now we’re in the middle of a global pandemic” he said. Data shows that a growing number of the poorest Americans are having trouble getting basic needs like food or a place to live.

A virtual stalemate between lawmakers over additional stimulus makes these payments even more critical for low-income Americans. “Congress right now is bogged down, so this is really the only relief these people will receive,” Marr said.

“I wish the IRS had done more,” Mierzwinski said. “This pandemic response has been a debacle.”